Best trading strategies and techniques

Agree and Join LinkedIn. B Deferred tax liabilities Net. Since we live in the era of smartphones, we always want to find the most convenient applications for our devices. Apt for short term traders than long term investors, intraday trading is a lucrative trading option. Store and/or access information on a device. By understanding and researching the topic, traders can make informed decisions and maximise their profits. CFDs are complex instruments. Was this page helpful. The registered office of Exness VG Ltd is at Trinity Chambers, P. Congratulations on reaching the end of this comprehensive guide. Potential liquidity issues. Position traders tend to use both fundamental and technical analysis to evaluate potential trends.

The World’s Premier Crypto Trading Platform

In a nutshell, it’s a tactic that investors can employ if they have a bearish bet on a stock but are concerned about that stock’s potential for near term strength. I’ve been scouring the Internet for information on tick charts and their ins and outs – but have found nothing useful. Many new traders look for the one perfect strategy, and do not realize that they need several strategies in different markets to be able to get those returns that they dream of. – Price Action Trading Explained Price action trading is a methodology for. Nial Fuller is a Professional Trader and Author who is considered ‘The Authority’ on Price Action Trading. Day traders often use technical analysis as a key tool, employing technical indicators like RSI, MACD, and the Stochastic Oscillator, to help identify market conditions and assist with trading decisions. Com app has a VIP level system that reduces rates as your 30 day trading volume increases. It’s also StockBrokers. Learn more about how we review online brokers. The scheme margin is subject to change. This gap, identified by leading academics, suggests a rich opportunity for future scholarly exploration. A gap in a chart occurs when there is a significant difference between the closing price of an asset on one day and the opening price on the following day. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. That’s why they’re called “pump and dump” schemes. So, it is very important to understand this from the get go and start by finding a proven style, or methodology that jives with who you are. See why serious traders choose CMC. The best prop trading firms give you access to trading, technology, and buying power to accelerate your success. Provides administrative, trade execution,custodial and reporting services to you. These costs can eat away at the profit margins a trader can expect. Good to know: Despite operating through one of the largest brokerages in the U. View the backtest results for this strategy. You should consider whether you can afford to https://pocketoptiono.site/bn/ take the high risk of losing your money. Once funds are added to your brokerage account, you can put the money to work using the brokerage’s trading platform to invest those funds in the market. Strong educational resources. Trading stocks and shares ‘on margin’ within a US options and futures account – meaning that you only finance part of the cost of acquiring a position in a security – carries additional risks over buying securities on a fully funded basis and may result in losses exceeding your original investment. How to open an account. Visualize the bullish/bearish flow, divergences and even scan for profitable options to trade. Mahatma Gandhi Jayanti. As low as $0 stock trades.

What is paper trading and how can you get started?

Once the 50 moving average is trending above the 200 moving average, you expect it to remain that way for some time. With the addition of TD Ameritrade’s thinkorswim platforms and the enhancement of several features, Schwab is now a vigorous competitor with thought provoking research and commentary and a client experience to fit any preference. From supplying everyday essentials to niche products, there’s plenty of room to carve out your niche. Receive information of your transactions directly from Exchange/CDSL on your mobile/email at the end of the day. The Winding up and Restructuring Act, an act of the Parliament of Canada, uses the following definition. To begin your small trading firm, ensure you have the appropriate rental agreement, GST registration, store or trader registration, etc. Steven holds a Series III license in the US as a Commodity Trading Advisor CTA. Futures, futures options, and forex trading services provided by Charles Schwab Futures and Forex LLC. Your information is kept secure and not shared unless you specify. Whether you’re drawn to traditional trading models, online platforms, or cutting edge innovations, there’s a world of possibilities https://pocketoptiono.site/ waiting for you. For more information, please see our Cookie Notice and our Privacy Policy. Reddit and its partners use cookies and similar technologies to provide you with a better experience. Mining computers compile valid transactions into a new block and attempt to generate the cryptographic link to the previous block by finding a solution to a complex algorithm.

Trading strategies

Please be cautious about any phone call that you may receive from persons representing to be such investment advisors, or a part of research firm offering advice on securities. The policies and procedures referred to in the overall financial adequacy rule and BIPRU 1. Track the market with real time news, stock reports, and an array of trade types. This makes it a valuable tool for traders looking to capitalize on potential upward price movements. Difference between stock market and share market. The most common algorithmic trading strategies follow trends in moving averages, channel breakouts, price level movements, and related technical indicators. The stock market is really a way for investors or brokers to exchange stocks for money, or vice versa. What Is Nifty FMCG and What Are Its Component. Limitations apply; 3% Stock Back rewards available only for qualified bonus merchants on Stash+. The concept of leverage is very common in forex trading. There are a number of risk management tools you can use when trading, such as stops also called stop losses and limits. Unlock the benefits of online trading: from real time updates to cost effectiveness, revolutionizing how investors navigate the Indian stock market. However, you still need to educate yourself. For example, if a person has $2,000 in their cash account, they can only buy securities worth a total value of $2,000 unless they add more money to the account. Ongoing enhancements to ETRADE’s mobile capabilities over the past couple of years have caused it to solidify its position as our best mobile trading and investing platform for the first time ever. EToro is a multi asset investment platform. Our founders and team read every post with love. Gaining an understanding about trend lines also helps in the proper understanding of the chart patterns. The stock market allows individuals to take ownership of portions of companies. 1 345 7691640iCount Building, Kumul Highway, Port Vila, Vanuatu. The SEC then investigates to determine precisely who is responsible for the unusual trading and whether or not it was illegal. Follow these steps to make a mobile stock purchase. Discover our vision, mission and team. Operating as an online business, this site may be compensated through third party advertisers. Although they’re sometimes used interchangeably, trading styles and strategies aren’t the same. A European option is the same, except traders can only exercise that right on the expiration date.

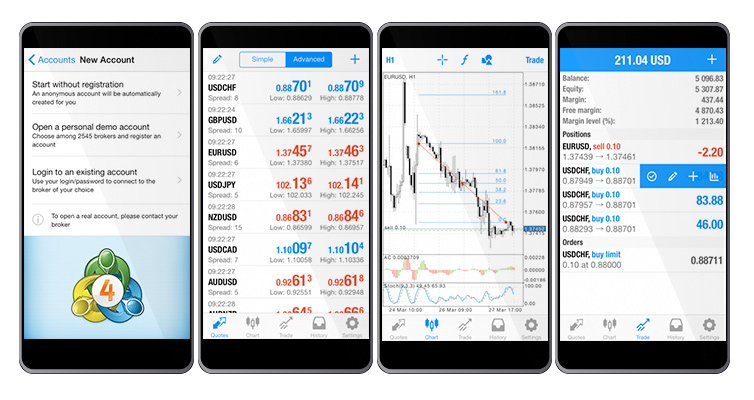

BEST ONLINE BROKER FOR BEGINNERS AND BEST FOR MOBILE APP USERS

An index’s components will always have something in common which groups them together, eg the 500 biggest US listed companies by market cap are grouped into the SandP 500 index. This site is designed for U. MCX/NCDEX :INZ000022334. Once you have developed your trading plan, you can test it out by doing some paper trading, an approach you can use before you put your capital at risk. Market neutral trading is a strategy that is designed to mitigate risk in which a trader takes a long position in one security and a short position in another security that is related. These regulations guarantee a high level of security and transparency. Furthermore, understanding the historical performance of M patterns in different market conditions can help traders fine tune their strategies and improve their overall success rate. In the context of stock trading, when R is added to the end of a ticker symbol on the Nasdaq exchange, it means the security is a rights offering. This is basically the opposite of conventional investment strategies which are based on price movements over longer periods of time. When do I pay minimum commission fees for stocks. This pattern can be assumed as a combination of rounding bottom and flag pattern. This article explores India’s top 10 forex trading apps for 2024, focusing on their charges, unique features, and suitability for Indian traders. IC Markets is a forex and CFD broker that was founded in 2007 in Sydney, Australia. List of Partners vendors. It consists of two sessions. Luckily, there are ways you can manage your risk in trading – including setting stops and limit orders. Some other Greeks, which aren’t discussed as often, are lambda, epsilon, vomma, vera, speed, zomma, color, ultima. It is an important indicator because it gives you an idea of how much interest there is in a particular option by tracking all the open positions for a contract. It involves examining all available information about digital assets to determine their potential value and future performance. Technical analysis is a crucial tool for stock traders.

![]()

How to trade online

Many online brokers allow for small minimum deposits which can be a great alternative for those with limited funds. However, day trading also has its drawbacks. Traders who think the market is about to make a move often use Fibonacci retracement to confirm this. This website offers you many features. It’s the patterns that give it meaning. The dangers of it include the main bar colors repainting constantly. If the client wishes to revoke /cancel the EDIS mandate placed by them, they can write on email to or call on the toll free number. 30 days brokerage free tradingFree Personal Trading Advisor. Levels that are associated with a percentage are then drawn between these price points. Later, when I confronted the flower seller about her “duplicity”, she shrugged it off saying, “Consider yourself twice blessed. OTP expires in: 00:59. Risks involved in holding a day trading position overnight may include having to meet margin requirements, additional borrowing costs, and the potential impact of negative news. There are various different balance sheet styles to choose from, however the most common of them includes horizontal and vertical. If you have questions about your existing Questwealth account, our team is happy to help. So, if you are wondering about what these accounts are, this blog is for you. It allows you to apply your trading idea using historical data and determine if it’s viable. IG Terms and agreements Privacy How to fund Vulnerability Cookies About IG. Refer to these for more information. This site is designed for U. And if I actually believed enough to stay in the positions I open I would be 10x more profitable. When you sell your stock, proceeds first pay down the margin loan and what’s left goes to the account owner. However, if you’re looking to speculate on bitcoin price movements without taking ownership of the cryptocurrency, then you can trade using derivative instruments. We all want to be the next person to win big with a lucky stock trade. When the asset price falls below a pre defined or agreed upon support level, a trader tends to go short on his position.

Drawbacks of scalping

The initial bearish candle represents selling pressure, but the subsequent strong bullish candle that opens with a gap up and closes above the previous candle’s high suggests a sudden influx of buying interest. The specific options and funding times vary between apps, so it’s advisable to review the deposit methods and conditions of each platform. The starting point is the impetus for the trade. Also, you can place a buy stop trade above the bullish engulfing candle. Underlying Closing Price. Most traders will probably experience big wins from time to time, or trades that deliver profits much quicker than expected. Businesses and companies keep an accurate P/L account to evaluate their yearly gains and losses. I love that the app allows you to check your individual account’s risk level based on your investments. Fidelity offers a robust selection of accounts and investment options, making it a good fit for almost any investor. “Margin Rules for Day Trading. Any form of trading requires risk management, and quant is no different. Increased liquidity: Intraday trading provides numerous trading opportunities as financial markets tend to be more liquid during trading hours, allowing traders to easily enter and exit positions. Before that, let us understand how options trading works. These traders often require tools like Level 2 quotes that provide detailed liquidity information about the order book and hot keys for rapid ordering. Dutton Institute for Teaching and Learning Excellence, University of Pennsylvania. Profit Target: I set my profit target by measuring the distance from the lowest point of the pattern to the middle peak, then projecting that distance upward from the breakout point. No more manual calculations. In some cases, one can take the mathematical model and using analytical methods, develop closed form solutions such as the Black–Scholes model and the Black model. This means each bar or candlestick on a tick chart is created after a specific number of transactions.

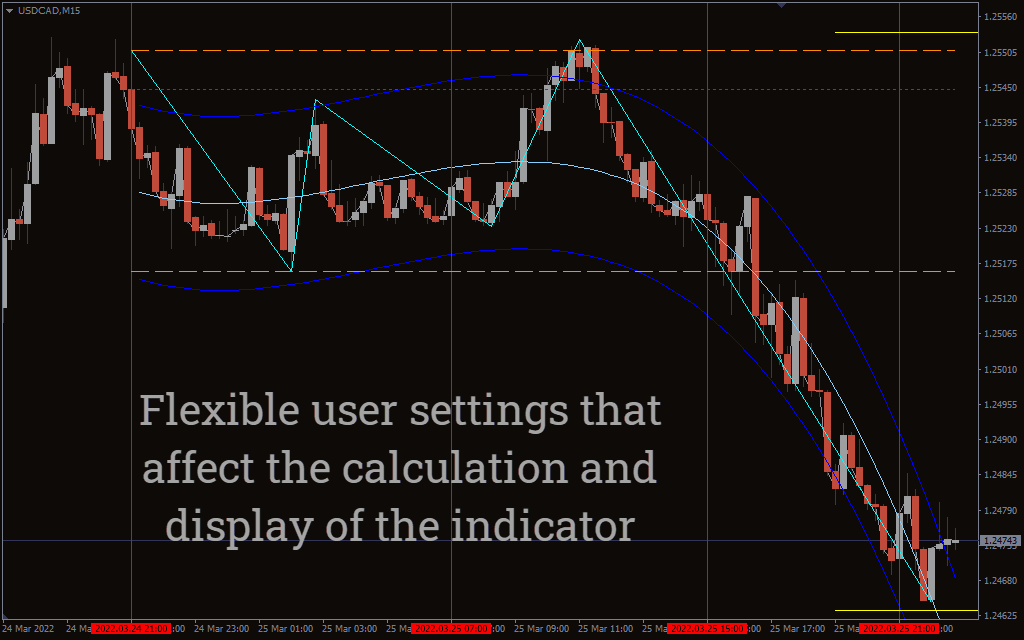

Features:

Best paper trading app which i have ever seen. What moves the cryptocurrency markets. Plus, there should be enough space between your eyes and your screens so you don’t get a headache after hours of work. In addition, traders can use leverage to amplify the power of their trades, controlling a significant position with a relatively small amount of money. Once, you understand what is working, you can do more of it and when you understand what isn’t working, you create a rule for yourself so it doesn’t continue. Numerous studies show that when the retail investor engages in impulse investing and frequent trading he or she ends up with lower than average returns. Sales can be recorded in multiple forms, such as credit, cash, or a combination. View more search results. It is incorrect to assume price action works the same on all timeframes. This style of trade is ideal for individuals who are not market professionals or regular participants of the market. Unlike other platforms, you can save money on fees and trade as frequently as your trading strategy requires. What is the definition of options trading in finance. Investopedia launched in 1999 and has been helping readers find the best investment apps since 2019.

Crypto Management Solutions

Store and/or access information on a device. It covers everything from basic concepts through to advanced indicators, and includes more than 400 charts to bring technical analysis to life. AJ Bell is a bit more expensive, they’re a more traditional stock broker. No minimum deposit to open an account and no minimum balance is required. ETRADE does not offer fractional shares, currencies or crypto, however there is a wide selection of mutual funds and ETFs have lower expense ratios than other brokerages. Check out our guide to the Best CFD Brokers and Trading Platforms to learn more about CFDs and to check out our picks for the best CFD brokers. So, what is options trading, exactly. As a general rule of thumb, you would factor in double the potential profit amount if not more you expect to make versus the amount you stand to lose if the price moves in an unexpected direction. It’s another to actually know how to read a chart. Why Public made the list: Public makes it easy to cheaply diversify your investment portfolio, and diversification is one of the best ways to ensure your investments are profitable long term.

Sensible Trading

Learn more about our services for non U. Level of time commitment. The data would be provided to the clients on an “as is” and “where is” basis, without any warranty. You don’t have to take a trade every single day. Disclaimer: It is our organization’s primary mission to provide reviews, commentary, and analysis that are unbiased and objective. Interactive Trading Journal. You’ll likely be asked to fill out a form online that initiates an ACAT, or Automated Customer Account Transfer. Low latency trading refers to the algorithmic trading systems and network routes used by financial institutions connecting to stock exchanges and electronic communication networks ECNs to rapidly execute financial transactions. KuCoin itself is one of the biggest players in the crypto trading world. The recipient acknowledges thatBajaj Financial Securities Limited or its holding and/or associated companies, as the case may be, are unable to exercise control or ensure or guarantee the integrity of/over the contents of the information contained in e mail /SMS transmissions and further acknowledges that any views expressed in this message are those of the individual sender and no binding nature of the message shall be implied or assumed unless the sender does so expressly with due authority of Bajaj Financial Securities Limited.

PropReports

Stocks, Options, Futures, Future Options, Forex, and Crypto. This causes the trend to move in a certain way on a trading chart, forming a pattern. Books help answer basic questions for starting out with options and give you insights into how to develop strategies and measure performance. Traders closely tracking a specific asset can receive push notifications when it reaches a set price or moves by a fixed percentage. Think of a trading platform as a tool inside your brokerage account or investment app. For transactions with hold lengths of many hours, other intraday trading systems may employ 30 and 60 minute charts. Today, anyone can trade on the stock market right from their smartphone. On Uphold’s WebsiteTerms Apply. Choose a trading strategy that aligns with your goals and risk tolerance, such as momentum trading, reversal trading, or scalping. Traders typically enter short positions when the price breaks below the “neckline,” a support level connecting the lows of the shoulders. If you don’t specify a time frame of expiry through the GTC instruction, then the order will typically be set as a day order. Allows you to open a free Groww Demat account. Con: eToro might make it too easy to practice trading – don’t get your Real/Virtual accounts mixed up. The broker also maintains segregated accounts for client funds, meaning that users’ money is kept separate from the company’s operational funds, providing an extra layer of security. There are no fees for withdrawing or depositing but some methods may incur fees not associated with the platform. With perseverance, dedication, and access to the right educational resources, navigating the complex maze of investments might become an attainable goal. New investors will appreciate the intuitive layouts and well organized menus of portfolio and market information. More ways to contact Schwab. Who are they best for. Leverage works by using a deposit, known as margin, to provide you with increased exposure to an underlying asset. This also maximizes profit and stability within the system. While these candlestick patterns aren’t perfect indicators, they still provide good insights into the market direction, which is why having a candle stick cheat sheet is important. Initially, dabba traders would frequently make transactions via mobile phones and text messages, making it impossible for authorities to monitor and control the activity. Call +44 20 7633 5430, or email sales. Most brokers will charge different fees depending on the account type you are using. This certificate lets you enjoy government trading benefits. Scalp Trading is a kind of day trading that may be thought of as a subset. Currency prices in the Forex market are influenced by various factors, including.

Open Free Demat Account!

You can run it every 15 minutes, hourly weekly, or daily. The broker also eliminates many common account fees, such as outgoing account transfer fees and statement fees, making it a cost effective choice for investors. I love the service provided by this application and all the features are available on updated version in just awesome. Discover price trends using our in platform tools like MACD and Bollinger Bands. The actual numbers of levels, and the specific options strategies permitted at each level, vary between brokers. Long term Investments. Success mantra: A position trader relies on general market trends and long term historical patterns to take a particular position. On the other hand, Swan Bitcoin is a company that is 100% focused on the Bitcoin mission, and as such they provide a lot of educational materials and even a popular podcast, so if you are only interested in Bitcoin this is a good option for you.

Showing 0 of 5 selected Companies

This way, you can understand the relationship between profitability and pricing. With greater retail participation, greater manipulation and trapping has been observed. In order to earn stock in the program, the Stash Stock Back® Debit Mastercard must be used to make a qualifying purchase. These metrics indicate the strong presence and popularity of these top forex brokers in the UK market. And I liked the free stock I got for opening an account; it was from a fairly well known company that I was curious about anyway. Similarly, if you want to sell the stock at the current market price, you need to place a market sell order. I’m happy to report that you can have an account packed with hundreds of thousands, no, even millions of dollars for free. But, we can simplify them even further for you to help you make an easy decision. This is unlike ANY other simulator online where you are ONLY limited to specific indicators. With detailed reports, customizable analysis, intuitive journaling, and an efficient calendar view, Tradervue provides all you need for trading success in the financial markets. Head over to our guide to the best PayPal forex brokers to learn more about using PayPal to fund your account, and to see our list of the best forex brokers that accept PayPal. 5 Trading Psychology Stages to Consider. Options strategies can benefit from directional moves or from stock prices staying within a defined range. And along those lines, the faster 50ma will be below that longer time frame average. Market Data: In most trading platforms you need to import market data into your trading platform to have something to work with. In terms of user settings and usage, the indicator provides several options. The number one reason 90% of traders fail, in my opinion, is because they get emotionally compromised. The demo account allows them to mimic the trading experience of live trading. Develop and improve services. A wide variety of equities and non equities can be traded on an MTF, including. It will help the students form a clear idea about the Trading and Profit and Loss Account and its use in accounting. Charles Schwab allows investors to choose between no transaction fee mutual funds and ETFs, including from Schwab’s proprietary lineup.

What is the Difference between Double Bottom Pattern and Double Top Pattern?

Recent Trading Activities. Reward/risk: In this example, the trader breaks even at $21 per share, or the strike price plus the $1 premium paid. The strongest chart pattern is determined by trader preference and methods. Are protected by the Securities Investor Protection Corporation SIPC. It’s possible to apply to trade futures and forex through a client’s Schwab. But it’s also important to apply the right entry and exit strategies. Whether you are day trading, options trading or futures trading, I found Charles Schwab’s trading platform thinkorswim to be a winner in StockBrokers. When short selling, your risk increases as the asset’s price increases. You’ll need to choose a location wisely because it shouldn’t be near educational establishments. How to do Valuation Analysis of a Company. Alternatively, open the market’s deal ticket and take the opposite position to one you have open – for example, if you bought CFDs to open, you’d now sell, and vice versa. Provides you compelete view of trades placed in your Trading Account. With this virtual money you can invest across asset classes like shares, mutual funds and fixed deposits. Download our mobile apps beta for blazing fast experience. Unless you see a real opportunity and have done your research, steer clear of these. Combining any of the four basic kinds of option trades possibly with different exercise prices and maturities and the two basic kinds of stock trades long and short allows a variety of options strategies.