Why Invest In A Gold IRA

We have hopens PDF file ad a longstanding relationship with NDIRA and we hold our own precious metals IRA with them. People must make sure they trust the correct business when they open a traditional IRA, but it’s even more important if they’re buying precious metal coins. American Hartford Gold makes it on this list for two key reasons offering a wide range of precious metals investment options such as platinum, gold, and silver – in both coin and bullion form, at reasonable prices, and, their exceptional customer services. List Direct Bullion USA as your precious metals dealer so we can help you along the way. They made it very easy to complete the process from beginning to end. Is there a minimum or maximum purchase amount. Goldco Pros and ConsPros.

Why Don’t Financial Advisers Recommend Silver and Gold IRAs?

Gold and silver have historically been one of the best hedges against inflation due to the increase in demand for precious metals when inflation is high. You can fund your account by rolling over a traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, or eligible 401k, 403b, TSP, or 457 account. The buyback commitment offered by American Hartford Gold is what stands out to us the most. In conclusion, a silver IRA can offer a robust and reliable retirement investment option that can help diversify and stabilize an individual’s portfolio. Here are the top 3 reasons to get a gold IRA with Augusta Precious Metals. It was only in 1998 that precious metals dealers were allowed to offer other types of precious metals like palladium and platinum bullions. GoldCo understands that investing in gold and silver can be a wise and secure choice for retirement savings. If sending funds via wire to the dealer, please fill out the Outgoing Wire Instructions Form, if the dealer cannot email instructions.

Robert H

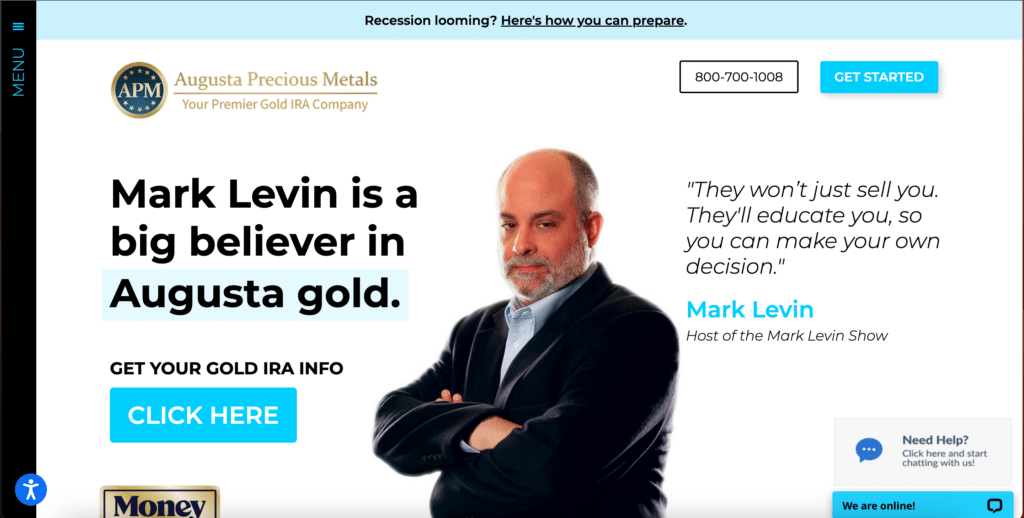

When planning for retirement, it’s important to consider all your investment options, including IRA approved silver. When it comes to investing for retirement, a outlookindia.com silver IRA is a great option. Alex and Marwan were EXCELLENT. Look for experienced companies that some with helpful investment advisors that can help you make important decisions regarding your IRA account. Metals are often the most expensive component of a product, and the cost can increase significantly if only a few suppliers offer the desired metal. Your options are to take any savings you already have or to use the income you make in the future. The gold IRA rollovers guide provides information on gold IRA companies that offer the best investment options, the lowest fees, and the best customer service. 4 Augusta Precious Metals is a trusted gold and silver IRA provider. This company features on this list because of its extensive experience in gold IRA investing. If You’re Looking for a Reliable Gold Buyer, Look No Further Than Gold Alliance. Digital Financing Task Force strives to keep its information accurate and up to date.

IRA Eligible Gold Bullion

The best option is to find a silver IRA company that offers a stress free, quick, and straightforward process. When corresponding with us please reference your customer number. They retain their value, or even grow, while other investments can decline. It is essential to choose a silver IRA company that is trustworthy has a positive track record with customers and the industry and knows about the current trends in the market. In some cases, investors may also be able to take physical possession of the precious metals themselves. Here are five questions to ask yourself before you close the books on last year’s taxes. Today, it’s a market leader and is one of the best gold IRA companies in the business.

Reviews from TrustPilot

Mountain West IRA does not sell or promote any products or vendors. We are available to assist you Monday through Thursday from 8AM to 6 PM ET, and Friday from 8AM to 5PM ET. Timely Opportunities Article. Traditional mortgage applications require documents provided by the applicant, appraisers, realtors, and mortgage brokers. Employees are either “civilian” or “uniformed. Payments into an IRA are tax refundable up to a certain annual limit $6,000 for people under 50 and $7,000 for people 50 or older, and you only pay income tax once you withdraw money from the account as a disbursement. You’re, therefore, better off with a gold IRA company to take you through the processes. Discover the Benefits of Investing in Noble Gold. Initiation fees, storage fees, yearly custodian fees, and other expenses may be among them. FinTech News and Information. When setting up a Gold and Silver IRA, investors should consider the fees associated with the account, the types of investments available, and the customer service offered by the company. We regularly handle every different type of product you can include in a precious metals IRA. Patriot Gold’s secure storage and reliable customer service are unmatched in the industry, making them one of the best gold IRA companies available.

Long term Safeguard and Protection

It even boasts of a celebrity clientele list, such as Ben Shapiro. If you have already weighed the pros and cons and are still interested in opening a Gold IRA, the following will walk you through the process of doing so. Give us 15 Minutes and we’ll walk you through everything you need to know, with no obligation. These fees may cover. Review the terms of service and privacy policy. Equity Trust Company is a directed custodian and does not provide tax, legal or investment advice. HSAs can help people cover healthcare costs and avoid other harmful financial decisions while enjoying tax breaks. About Goldco Precious Metals.

AuSecure

All You Need to Know in Buying Gold and Silver for Your IRA. In July 2020, gold prices were the highest since September 2011, hitting a high of almost $2,000 an ounce. Between 1971 and 1981, when the US dollar lost more than half of its value, silver prices rose almost five times, during which time silver reached an all time high in 1980. Aside from being an excellent store of value, gold and silver are considered liquid assets. Their commitment to quality and customer service make them an excellent choice for IRA silver services. However, the upside is that it is a cheaper option than segregated vault storage, and they tend to have a flat custodian fee. With unallocated or unsegregated storage, the metals are commingled in a depository metal account. GoldStar Trust provides links to web sites of other organizations in order to provide visitors with certain information. The whole process was very smooth. This gorgeous coin features Ian Rank Broadley’s famous effigy of Queen Elizabeth II on the obverse, while the reverse features an image of the Mayflower.

Watch on your favorite streaming device live or on demand 24/7!

Buyers are told the coins will only go up in value because of their rare or collectible nature. Open your account and choose your funding source: Birch Gold Group requires a minimum investment of $10,000. It also uses Delaware Depository, which offers insurance of up to $1 billion. For many individuals, transferring their retirement savings into a precious metals IRA is the best option. When it comes to investing in gold for your retirement, it is important to work with a broker or custodian that has experience in dealing with gold. You accept and acknowledge First Fidelity’s Terms and Conditions for customers and website visitors.

III Maximum Assistance

Limited international shipping options. However, Midland is not a fiduciary and has no role in determining whether metals are the right investment strategy for anyone. Talk to Augusta Precious Metals about how you can get no fees for up to 10 years. Goldco Highest rated and most trusted. You’ll also want to make sure that your portfolio remains balanced by occasionally selling off some of what you’ve purchased throughout the year if prices go up too far beyond where they were when you bought them originally. However, they’re not immensely expensive either. These accounts are offered by many financial institutions and allow investors to hold physical gold and silver in their retirement accounts. Investors should do their research and understand the risks associated with investing in a Silver IRA in order to make an informed decision that is best for their financial situation. However, to ensure a successful investment, it’s essential to choose a reputable broker or custodian to facilitate the transaction. These Precious Metals IRAs have become increasingly popular in recent years as more uncertainty grows around the health of the global economy.

Other Lenders

It works just like an ordinary IRA, except instead of dealing in paper currency, it deals in physical bullion gold coins or bars. A Gold IRA is a retirement account that allows you to invest in precious metals such as gold, silver, platinum, and palladium. With the current market volatility, it is more important than ever to make sure your retirement savings are secure. He’s built a team of experts around him that understand the market including the Director of Education Devlyn Steele who has processed over $2B worth of financial transactions and is a member of the business analytics program at Harvard Business School. By using an IRS approved depository, the assets in the precious metal IRA are kept separate from the custodian’s own assets and are protected in the event of bankruptcy or other financial difficulties. We love American Hartford’s mission to give back to the community. If you are interested in learning more about buying or selling annuities, call us at 866 528 4784. When you look at the different IRA companies, there is a vast difference in their pricing. When people invest in gold and silver, their contributions and gains might not be taxable. How many grams of gold can I sell before having to contact the IRS. Augusta Precious Metals will store your gold IRA investment through Delaware Depository, one of the best private depositories in the U. Carefully distinguishing between a transfer and rollover is critical because there are fewer restrictions and penalties associated with a precious metals IRA transfer compared to a precious metals IRA rollover.

American Hartford Gold

World famous and reliable, a great choice for beginners and experts alike. The minimum investment is $25,000. Advantage Gold cannot guarantee, and makes no representation, that any metals purchased i. Since 1999 we have produced high quality. I’m looking towards New Silver to handle my next deal. Protect Your Assets With Birch Gold Group. The fees and minimum investment amounts charged by gold IRA companies are important to evaluate relative to the services they provide. These ETFs allow investors to gain exposure to the price movements of precious metals without owning physical assets. People are not able to open a precious metal IRA account from scratch sometimes. For every transaction, customers deal directly with a company manager who is also a precious metals specialist. On the other hand, pre tax funds rolled into a traditional IRA are not taxed until they are withdrawn.

+1 855 655 4653

Please inquire with your IRA custodian for specific plan details or any plan limitations. With Birch Gold Group, customers are provided competitive prices for both buying and selling bullion coins and bars without hidden fees or commissions attached. By adding gold investments to your retirement portfolio, you will be able to protect your savings against inflation and currency devaluation. Contributions are tax deductible – very similar in nature to Traditional IRA. In this guide, I’ve selected the best silver IRA providers for 2022 based on their reliability, reputation, and customer reviews. This privilege is only offered by very few custodians. A self directed IRA is an individual retirement account that can hold investments or assets that a standard IRA cannot. In summary, investing in IRA silver can provide investors with diversification, an inflation hedge, a safe haven asset, potential for growth, and tax advantages. If a person is not listed as an interested party, you’ll need to be there or on the telephone for every interaction between that person and your custodian. When choosing a broker or custodian for your gold and silver IRA, it’s essential to do your due diligence and research potential candidates thoroughly. At 1RATE, you get tailor made mortgage loan solutions that fit within YOUR unique requirements. They’re buying precious metals. The company’s commitment to providing quality service and support makes them a great choice for those looking to diversify with silver. To contact American Hartford Gold, call 877 672 6779 or request a free starter kit.

Anna Miller

IRA Custodians are required by the IRS for maintaining, assisting, and safeguarding your precious metals. Be the first to review. Best for Gold Bullion. Knowing that you are receiving industry insights from a Harvard trained economic analyst lead staff also makes you feel like you are capable of investing like a professional for more proud, confident decisions. Investors who prefer Silver Eagles should ask about backdated Silver Eagles before putting current year Silver Eagles in their IRAs. Get the quick takeaway with these pros and cons. The process for a gold IRA Rollover can be a complex one, but it can be made easier with the help of the best gold IRA companies. There are a number of reasons to invest in a precious metals IRA, most notably consistent growth opportunity and tax benefits.

US Reviews

Gold, silver, platinum and palladium cannot be stored just anywhere. Because of IRS rules, you cannot take a distribution from your gold IRA until you are 59 ½. In addition, the company charges storage fees of $100 and $150 for non segregated and segregated accounts, respectively. The best gold IRA companies will have a reputation for providing excellent customer service and expertise. With a high paying affiliate program – that pays up to 50% of the net profit from generated sales – you can also have true peace of mind knowing that your friends and family will be in good hands. The decision to buy, sell, or borrow precious metals, and which precious metals to purchase, borrow, or sell, are made at the customer’s sole discretion. Please consult with a professional specializing in these areas regarding the applicability of this information to your situation. If you fail to meet certain conditions when using it, you will be made liable for tax penalties under the law. FTC Disclosure: We are an independent blog that aims at providing useful information for retirement account owners interested in alternative assets like precious metals. Subscribe to our RSS feed to get the latest content in your reader. Where’s the security in that arrangement. Noble Gold: Good for smaller gold investments.